Source: Deloitte and Neal Batra United States David Betts United States Steve Davis United States

The future of health will likely be driven by digital transformation enabled by radically interoperable data and open, secure platforms. Health is likely to revolve around sustaining well-being rather than responding to illness.

TWENTY years from now, cancer and diabetes could join polio as defeated diseases. We expect prevention and early diagnoses will be central to the future of health. The onset of disease, in some cases, could be delayed or eliminated altogether. Sophisticated tests and tools could mean most diagnoses (and care) take place at home.

Learn More

Explore the Health care collection

Subscribe to receive related content from Deloitte Insights

Today, the US health care system is a collection of disconnected components (health plans, hospital systems, pharmaceutical companies, medical device manufacturers). By 2040, we expect the consumer will be at the center of the health model. Interoperable, always-on data will promote closer collaboration among industry stakeholders, and new combinations of services will be offered by incumbents and new entrants (disruptors). Interventions and treatments are likely to be more precise, less complex, less invasive, and cheaper.

Health will be defined holistically as an overall state of well-being encompassing mental, social, emotional, physical, and spiritual health. Not only will consumers have access to detailed information about their own health, they will own their health data and play a central role in making decisions about their health and well-being.

What is the future of health?

The future of health that we envision is only about 20 years off, but health in 2040 will be a world apart from what we have now. Based on emerging technology, we can be reasonably certain that digital transformation—enabled by radically interoperable data, artificial intelligence (AI), and open, secure platforms—will drive much of this change. Unlike today, we believe care will be organized around the consumer, rather than around the institutions that drive our existing health care system.

By 2040 (and perhaps beginning significantly before), streams of health data—together with data from a variety of other relevant sources—will merge to create a multifaceted and highly personalized picture of every consumer’s well-being. Today, wearable devices that track our steps, sleep patterns, and even heart rate have been integrated into our lives in ways we couldn’t have imagined just a few years ago. We expect this trend to accelerate. The next generation of sensors, for example, will move us from wearable devices to invisible, always-on sensors that are embedded in the devices that surround us.

Many medtech companies are already beginning to incorporate always-on biosensors and software into devices that can generate, gather, and share data. Advanced cognitive technologies could be developed to analyze a significantly large set of parameters and create personalized insights into a consumer’s health. The availability of data and personalized AI can enable precision well-being and real-time microinterventions that allow us to get ahead of sickness and far ahead of catastrophic disease.

Consumers—armed with this highly detailed personal information about their own health—will likely demand that their health information be portable. Consumers have grown accustomed to transformations that have occurred in other sectors, such as e-commerce and mobility. These consumers will demand that health follow the same path and become an integrated part of their lives—and they’ll vote with their feet and their wallets.

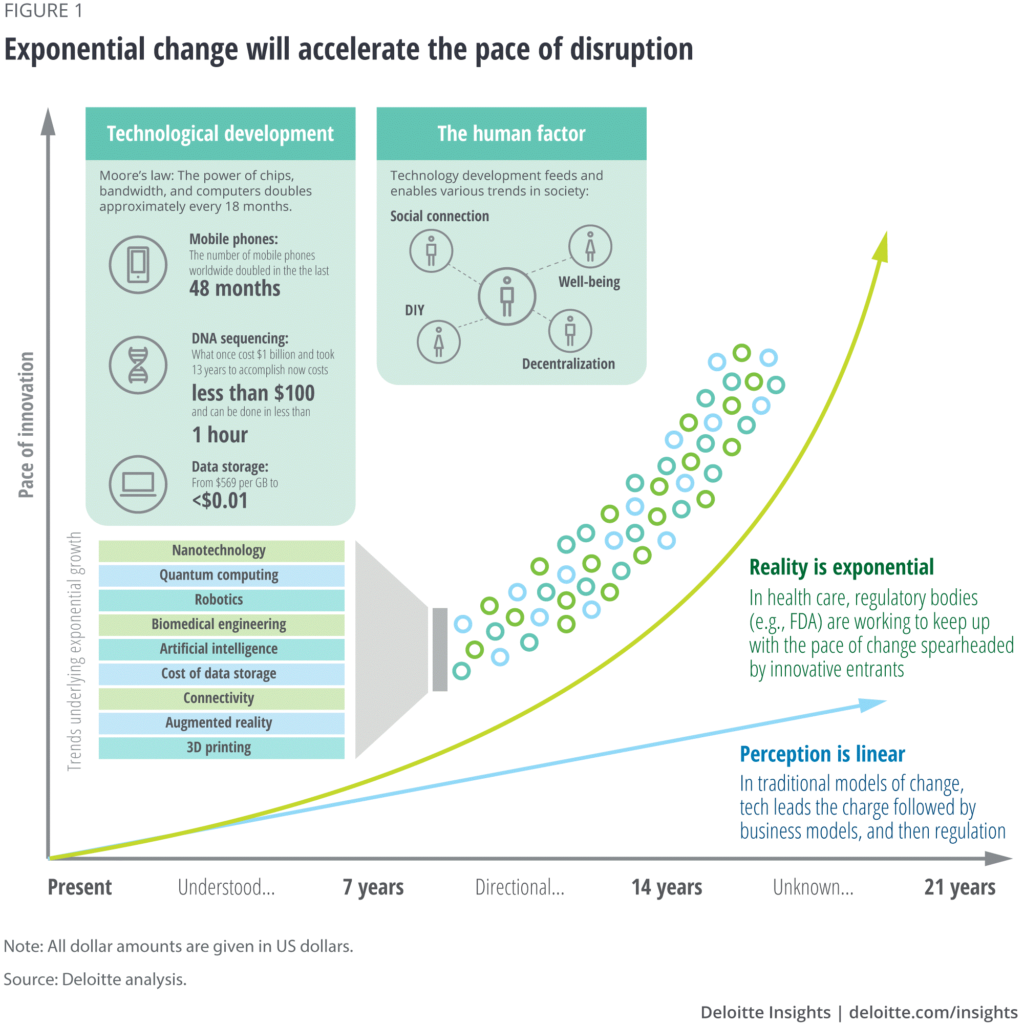

Exponential change and innovation cycles

While we don’t know with precision how the future will play out, we can look at signals in the market today—and the forces of change in other industries—to start to paint a picture of the future of health. In virtually every industry, fundamental shifts in innovation tend to occur in seven-year cycles (figure 1). Health is no different. By 2040, three of these cycles will have passed—each building off of the other. To determine where health might be headed, we should look back three innovation cycles and consider where exponential innovation has taken us. Figure 2 shares several examples.

Why does the future of health matter?

Nothing is more important than our health. All of us interact with the health care system to varying degrees, and we will continue to interact with it throughout our lives. The cost of health care affects individuals, families, and employers as well as local, state, and federal budgets. In 2017, US health care spending topped US$3.5 trillion (17.9 percent of the gross domestic product). That translates to US$10,739 for every person in the country.6

An estimated 133 million Americans have at least one chronic disease (such as heart disease, asthma, cancer, and diabetes), and the number of people who have a chronic illness has been rising steadily for years.7 Hospital care now makes up about one-third of all health care spending in the United States, and chronic illnesses are tied to more than 80 percent of hospital admissions.8 While chronic diseases are typically incurable, they can often be prevented or managed.

Health care consumers typically interact with the health system only when they are sick or injured. But the future of health will be focused on well-being and prevention rather than treatment. As illustrated by figure 2, we predict that more health spend will be devoted to sustaining well-being and preventing illness by 2040, while less will be tied to assessing conditions and treating illness. Greater emphasis on well-being and identifying health risks earlier will result in fewer and less severe diseases, which will reduce health care spending, allowing the reinvestment of this well-being dividend to expand the benefits to the broad population. Along with helping to improve the well-being of individuals, health care stakeholders will also work to improve population health. Interoperable data sets will be used to drive microinterventions that help keep people healthy (figure 3).

Health care consumers typically interact with the health system only when they are sick or injured. But the future of health will be focused on well-being and prevention rather than treatment. As illustrated by figure 2, we predict that more health spend will be devoted to sustaining well-being and preventing illness by 2040, while less will be tied to assessing conditions and treating illness. Greater emphasis on well-being and identifying health risks earlier will result in fewer and less severe diseases, which will reduce health care spending, allowing the reinvestment of this well-being dividend to expand the benefits to the broad population. Along with helping to improve the well-being of individuals, health care stakeholders will also work to improve population health. Interoperable data sets will be used to drive microinterventions that help keep people healthy (figure 3).

In response to this shifting health landscape, traditional jobs we know today will undergo change. Health will be monitored continuously so that risks can be identified early. Rather than assessing patients and treating them, the primary focus will be on sustaining well-being by providing consumers ongoing advice and support.

We don’t expect disease to have been eliminated entirely by 2040, but the use of actionable health insights—driven by interoperable data and smart AI—could help identify illness early, enable proactive intervention, and improve the understanding of disease progression. This can allow us to avoid many of the catastrophic expenses we have today. Technology might also help break down barriers such as cost and geography that can limit access to health care providers and specialists.

Health systems, health plans, and life sciences companies have begun to shift some of their focus to wellness, but the overall system remains focused on sick care.

Interoperable data will empower consumers

Radically interoperable data and AI can empower consumers in ways that are difficult to visualize today. Data about individuals, populations, institutions, and the environment will be at the heart of the future of health.

Most of the care provided today is highly algorithmic and predictable. By 2040, high-cost, highly trained health professionals will be able to devote more time to patients who have complex health conditions. Data and technology will empower consumers to address many routine health issues at home. Consider a child who has an ear infection. Rather than taking the child to a clinic or doctor’s office, an at-home diagnostic test could be used to confirm the patient’s diagnosis. Open and secure data platforms would allow the parent to verify the diagnosis, order the necessary prescription, and have it delivered to the home via drone. Or maybe the ear infection never materializes because the issue is identified and addressed before symptoms appear. In this case, a prescription isn’t needed at all because the parents intervened early. In both scenarios, consumers address health issues at home while allowing physicians to focus on cases that truly require human intervention.

The consumer—rather than health plans or providers—will determine when, where, and with whom he or she engages for care or to sustain well-being. Over the next 20 years, all health information will likely become accessible and—with appropriate permissions—broadly shared by the consumers who own it.

But consumers might not be willing to share this information with organizations that don’t offer value, or that aren’t trusted. Consumers tend to trust hospitals and physicians more than other health care organizations, according to our 2018 consumer survey. While trust in health plans and pharmaceutical companies is relatively low, consumers are twice as likely to trust information from these groups as they were in 2010. Health stakeholders should consider ways to earn the trust of these empowered consumers.

How will technology help improve well-being?

Consumers are growing accustomed to wearable devices that track activity. Deloitte’s 2018 US Health Care Consumer Survey shows that consumers are tracking their health and fitness data two and a half times more today than they were in 2013. Data-gathering devices will become exponentially more sophisticated and will continuously track activity, health, and environmental factors. This ongoing monitoring can help ensure that health conditions and risks are identified and addressed early. In rare instances when treatment is needed, it can be highly personalized.

Consumers can already remotely adjust thermostats, set alarms, and turn on lights in their homes. Cycle that forward to a home equipped with remote-monitoring biosensors. This might include a hyperconnected bathroom where the mirror and other tech-enabled appliances process, detect, and analyze health information. Highly attuned sensors embedded in a bathroom mirror, for example, might track body temperature and blood pressure, and detect anomalies by comparing those vitals to a person’s historical biometric data. Maybe this smart mirror even plays a skin care tutorial reminding the user to apply sunscreen based on that individual’s plan for the day together with the weather forecast. Analyses conducted by a tech-enabled toilet might be able to spot biomarkers that would indicate a potential change in health status long before symptoms appear.

Outside of the home, environmental sensors might detect UV levels, air pressure changes, and pollen levels. Such information could help keep consumers in tune with their health and quickly spot issues that could indicate the early stages of illness or disease. Rather than picking up a prescription at the pharmacy, personalized therapies based on a person’s genomics could be dropped off via drone when needed.

What are the impacts of the future of health?

The future of health will impact incumbent stakeholders, new entrants, employers, and consumers. Many incumbents are understandably hesitant to drive change in a marketplace that they currently dominate. Given their strong foothold in the existing ecosystem, and their ability to navigate the regulatory environment, these organizations may be well-positioned to lead from the front.

Technology-focused companies such as Google, Amazon, and Apple9 are beginning to disrupt the existing market and reshape the model. Legacy stakeholders should consider whether to disrupt themselves or isolate and protect their offerings to retain some of their existing market share. Incumbent players that are able to reinvent themselves could help usher in the future of health, while some could succumb to competition coming from outside the traditional industry boundaries.

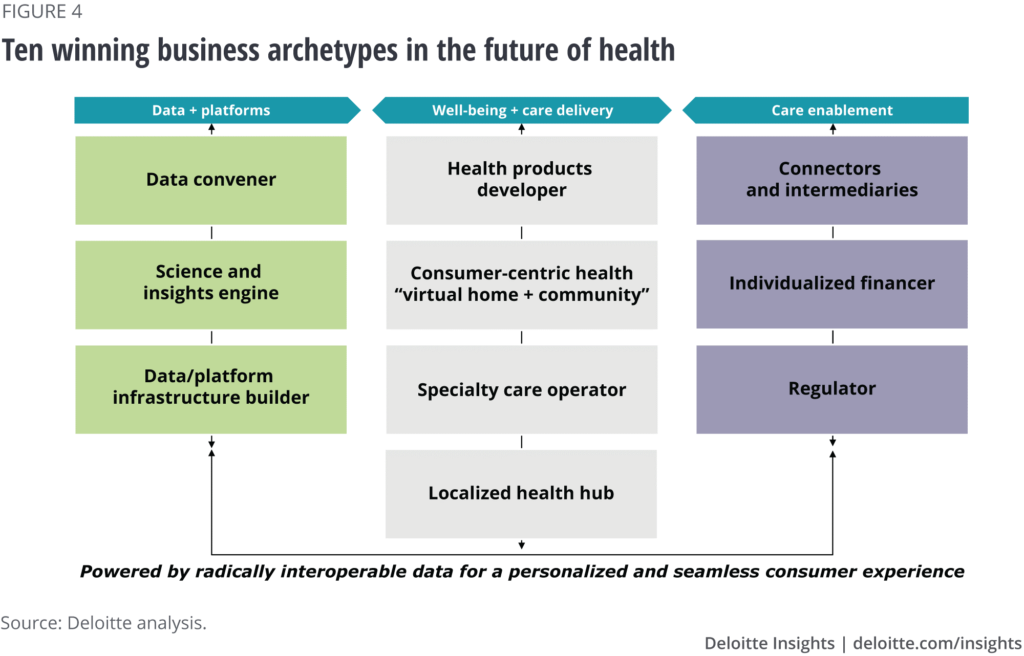

We anticipate that by 2040 successful companies will identify and compete in one or more of the new business archetypes illustrated in figure 4, taking into consideration their existing capabilities, core missions and beliefs, and expectations for the future.

Largely replacing the siloed industry segments we have now (such as health systems and clinicians, health plans, biopharmaceutical companies, and medical device manufacturers), we expect new roles, functions, and players to emerge. In the future of health, we expect three broad categories to emerge (data and platforms, well-being and care delivery, and care enablement). Within these categories, we envision 10 archetypes. Organizations might exist in more than one category, but they typically will not take on all archetypes in a category.

Data and platforms. The future of health will require that data be collected from multiple sources to enhance research, to help innovators develop analytic tools, and to generate the insights needed for personalized, always-on decision-making. Organizations focused on data and platforms can capture an increasingly significant share of the profit pool as they provide the infrastructure to engage consumers, facilitate data access and analysis, and connect stakeholders across the industry. These archetypes will serve as the backbone for the health care ecosystem of tomorrow.

- Data conveners (data collectors, data connectors, and data securers).These organizations will have an economic model built around aggregating, storing, and securing individual, population, institutional, and environmental data. This data can be used to drive the future of health.

- Science and insights engines (developers, analytics gurus, insight discoverers).Some organizations will likely have an economic model driven by their ability to derive insights and define the algorithms that power the future of health. These organizations can use machine-led activities to conduct research, develop analytical tools, and generate data insights that go far beyond human capabilities.

- Data and platform infrastructure builders (core platform developers, platform managers and operators).This new world of health will need infrastructure and platforms that can serve highly empowered and engaged individuals in real time. (Someone will need to lay the pipes.) A limited number of large-scale technology players will develop core platforms, interfaces, and infrastructure to enable data sharing, virtual health, and consumer-centric health. They will also develop standards for platform and application integration, architecture, and user experience.

Well-being and care delivery. Community health hubs, specialty care operators, virtual communities and care-delivery mechanisms, and product developers will work in partnership with one another to drive a tailored promotion of health and well-being. These virtual and physical communities will provide consumer-centric delivery of products, care, and well-being. Health stakeholders that focus on well-being and care delivery today typically capture a majority share of the profit pool as direct providers of care. However, they should embrace new ways of working, new ways of engaging consumers, and new ways of delivering well-being services and care to compete effectively.

- Health products developer (application developers, inventors/innovators, manufacturers).The economic model of these organizations are driven by their ability to enable well-being and care delivery. Medical products might no longer be limited to pharmaceuticals and medical devices. They could also include software, applications, wellness products, even health-focused foods. The home bathroom of the future, for example, might include a smart toilet that uses always-on sensors to test for nitrites, glucose, protein, and pH to detect infections, disease, even pregnancy. A smart mirror equipped with facial recognition might be able to distinguish a mole from melanoma. Breath biome sensors in a smart toothbrush might detect genetic changes that indicate early stages of disease. Foods might be modified to contain cancer-killing bacteria that integrate into the consumer’s biome.

- Consumer-centric health/virtual home and community (virtual health providers and enablers, and wellness coaches).Along with companies that develop health products, other organizations will provide the structure that supports virtual communities. These communities could be defined by geography, or they might be communities made up of people with a certain health condition. A community could also be comprised of a patient, his or her family members, and supporters.

- Specialty care operators (world-class health centers, event-specific facilities).Two decades from now, we will still have disease, which means we will still need specialty care providers and highly specialized facilities where those patients can receive care.

- Localized health hubs.While there will be some specialty care, most health care will likely be delivered in localized health hubs. The brick-and-mortar hubs will serve as shopping centers for education, prevention, and treatment in a retail setting. Additionally, local hubs will connect consumers to virtual, home, and auxiliary wellness providers.

Care enablement. Financiers and intermediaries will facilitate consumer payment and coordinate supply logistics, respectively, but they could experience decreases in margins and share of profits, driven by advanced analytics and risk assessment.

- Connectors and intermediaries (enterprise tool developers, supply chain designers and coordinators, delivery service providers).These are the logistics providers that will run the just-in-time supply chain, facilitate device and medication procurement operations, and get the product to the consumer.

- Individualized financiers (N of 1 insurers, catastrophic care insurers, government safety net payers).Similar to health insurers of today, these organizations will create the financial products that individuals will use to navigate their care, but these products will offer more specific, tailored, and modular products, as well as catastrophic care coverage packages. Some individual financiers will include noninsurance financing products (for example, loans, lines of credits, subscriptions). They will drive reductions in care costs by leveraging advanced risk models, consumer incentives, and market power.

- Regulators (market leaders and innovators, government regulators and policy makers).While we will still have regulators, we probably won’t view them as governmental traffic cops. They will set the standards for how business is transacted. The regulators of the future will influence policy in an effort to catalyze the future of health and drive innovation while promoting consumer and public safety (they might be as much collaborators in transformation as stewards).

How do we expect incumbent players to change?

We envision an era of unprecedented change and opportunity. New business models will incorporate these archetypes and redefine the health landscape. Organizations should choose where they want to play across these archetypes. For example:

- Hospitals and health systems.The acute-care hospital will no longer serve as the center of gravity. Instead, the center of gravity in this new system will be consumers. Organizations that want to play a role in the delivery of care should determine how they can expand their points of access to get closer—both physically and digitally—to their customers. Health care providers should also find ways to decrease delivery costs to maintain margins. Near-term strategies might include enabling patient self-service, creating more remote and virtual health solutions, digitization, and advanced population management.

- Health plans.Health plans will likely develop new business models that move beyond claims processing to focus on members’ well-being, according to Deloitte research on the health plan of tomorrow. We expect health plans to become data conveners, science and insight engines, and/or data and platform infrastructure builders. Using the wealth of data they possess, health plans could develop new revenue streams based on consumer insights, monetization of data, population health initiatives, and customized offerings.

- Medical device companies.An increased focus on prevention and early intervention—combined with advances in biosensors and digital technology—can create new opportunities for medical technology companies. But they might not be able to take advantage of those opportunities on their own. Over the next two years, more than 80 percent of medtech companies expect to collaborate with organizations from outside of the health sector, according to a survey by the Deloitte Center for Health Solutions and AdvaMed.

- Drug manufacturers.Biopharmaceutical companies are set to develop hyper-tailored therapies that cure disease rather than treat symptoms. Individual drug prices could rise as therapies become more efficacious and applied in more targeted populations. However, overall drug spending could decrease as the unit volume falls. Advanced early intervention and enhanced adherence could also help ensure the effectiveness of these new therapies.

What should you do next?

The health industry is on the cusp of a transformation that will affect all stakeholders. Incumbent players can either lead this transformation as innovative and well-connected market leaders or they can try to resist this inevitable change.

A wide range of companies—from inside and outside of the health care sector—are already making strategic investments that could form the foundation for a future of health that is defined by radically interoperable data, open and secure platforms, and consumer-driven care.

As stakeholders prepare for the future of health, they should consider the following actions:

- Build new businesses.The incidence and prevalence of major chronic diseases (for example, type 2 diabetes, hypertension, COPD) will likely decline dramatically. In response, health organizations should adjust their business models to stay competitive.

- Forge partnerships.Technology giants, start-ups, and other disruptors are new to the health care landscape but are incentivized to drive change. What they lack is health care expertise, regulatory expertise, a targeted consumer base, and existing partnerships with other incumbents. Disruptors will likely be more willing to partner with incumbents that are seen as driving innovation.

- Appeal to the newly empowered health consumer.Stakeholders should develop tactics to engage effectively with consumers. They should also work to earn their trust and demonstrate value. Consumer attitudes and behaviors are malleable in the future of health. Interoperable data, machine and deep learning capabilities, always-on biosensors, and behavioral research can enable personalized and real-time AI-driven behavioral interventions that shape consumer beliefs and actions.

In the future of health, incumbents and industry disruptors will share a common purpose. While disease will never be completely eliminated, through science, data, and technology, we will be able to identify it earlier, intervene proactively, and understand its progression to help consumers effectively and actively sustain their well-being. The future will be focused on wellness and managed by companies that assume new roles to drive value in a transformed health ecosystem. If this vision for the future of health is realized, we could see healthier populations and dramatic decreases in health care spending. If we’re right, by 2040, we might not recognize the industry at all.

Topics in this article

Health Care , Digital Transformation , Innovation , Center for Health Solutions , Emerging technologies

The Future of Health

The health industry is on the cusp of a major transformation that will affect all stakeholders. Incumbent players can either lead this transformation as innovative and well-connected market leaders or they can try to resist this inevitable change. A wide range of companies—from inside and outside of the health care sector—are already making strategic investments that could form the foundation for a future of health that is defined by radically interoperable data, open and secure platforms, and consumer-driven care.

Get in touch

- David Betts

- Principal, national leader for Customer Transformation

- Deloitte Consulting LLP

- dabetts@deloitte.com

- +1 412 402 5967